Bitcoin and financial security

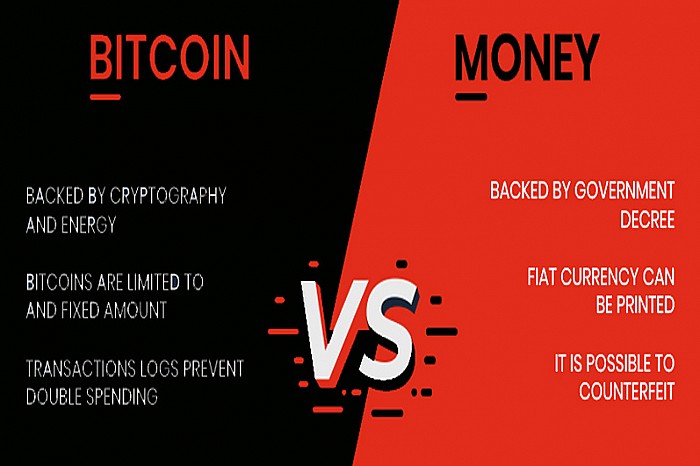

Bitcoin emerged as the newest form of cryptocurrency in 2009 and promised to take currency transactions to a different level. This innovative digital currency is decentralized in nature and is capable of facilitating a user to user payment without the intervention of any central bank or centralized administrator in between. Thus, with Bitcoins, users can enjoy instant fund transfer facilities at a comparatively lower transaction fee than that of the traditional online payment system.

Even though Bitcoins offer a range of benefits, there are lots of speculations among the investors about the financial security provided by this digital currency. Therefore, let us examine how safe is a Bitcoin for an investor.

- The debasement of the leading currency turns can be interpreted as favourable

Investors who plan to invest in Bitcoin in situations when the central bank announces debasement of the cure currency that is in circulation would be gaining from the deal.

Here, the fundamental has to be understood very clearly. The cryptocurrency was introduced during a time when the worldwide recession was at its peak. The purpose of this currency introduction was to overcome the after effect of the financial crisis and drive growth in the money market through the introduction of cheap monetary policy.

The supply of cryptocurrencies during this time was limited as compared to core currency, and the status quo has been maintained ever since then. Thus, the price of cryptocurrencies is always higher than that of the core currencies.

The value of cryptocurrency will go up if this situation prevails, and the central bank continues to use Bitcoin as a means to check monetary expansion by continuing to impose restrictions its supply. So, investors will continue to have a secured future with Bitcoin investments.

- Storing value is still obscure and cannot be considered dependable

Storing value with Bitcoins in a consistent manner still exists as an unresolved question.

If you compare the financial scenario of 2017 to 2018, you would probably find that by 2017 the value of cryptocurrency rose to approximately $20,000 per Bitcoin value. Towards the end of 2018, the value dropped further by roughly $4000.

The scenario got even more unpredictable with the onset of COVID-19 when the value of Bitcoin dropped to almost $5000 within the first three months of 2020. The jump was unexpected around August 2020 when the value touched nearly $12,000.

If this fluctuation in the value of Bitcoin is compared with any other asset like gold or property, you will find that it will be dramatically erratic.

So, it is not undeniable that Bitcoin is still not in a position to offer consistent financial security to the investors.

- Higher interest rates might be tempting and worth taking the risk

The governments of all the countries of the world intervene and develop strategies for saving the economy when there is any financial doldrum.

Usually, such situations are handled by reducing the value of currencies that are centrally controlled. Lots of centralized currencies are printed during such phases, and the interest rates are dropped drastically.

However, Bitcoin remains unaffected during such phases because it is decentralized. The comparative interest value of this digital currency remains unchanged and appears noticeably higher than the centralized currency. Now, this is definitely a temptation for any investor.

Therefore, investing in Bitcoin is safe, particularly during the times when the inflation-adjusted interest rates of assets like stocks are low, as well as interest rates of fiat currencies become low.

Nonetheless, being cautious is mandatory when investors think of investing during such times. They have to remain well-prepared to take immediate steps when this Bitcoin favourable momentum gets disturbed and becomes vulnerable to sudden disruptions.

- Regulators need to be dealt strategically to reap benefits

Currency related regulations that are often imposed by the market regulators are interpreted by different investors differently.

It should be noted here that central banks, that are the creators and regulators of traditional currency, always remain in the fear that these digital currencies can take over the financial market. As a consequence, they might cease to have any further control over money creation as well as monetary policy. Therefore, these central banks might introduce regulations that go against Bitcoin.

The second type of regulation comes from market regulators such as Securities and Exchange Board of India (SEBI). The core objective of these organizations is to scrutinize the colour of money that comes into an economy and regulate the unnecessary inflow of black money.

In unfortunate situations, SEBI might become scornful about Bitcoin and impose regulations that restrict free circulation of this cryptocurrency into the economy.

However, the good news is that Bitcoin is in the good books of SEBI until date, and these are only assumptions.

So, investors who are risk-takers and do not maintain unnecessarily pessimistic approach in regards to investing with Bitcoin can go for it. Nonetheless, investors who look too much into things and speculate too much might think twice before investing in Bitcoin.

- Institutionalization of Bitcoin can be counted as favorable

Countries like India are still in their nascent stages as far as the institutionalization of Bitcoin and its parallel use as that of core currencies are concerned. Therefore, it cannot still be concluded by the investors of these countries that investing in Bitcoin is a safe proposition.

Again, some prominent developed countries like Japan and Germany are really thinking seriously about cryptocurrency. These two countries have encouraged free trading in Bitcoins. This cryptocurrency is also finding use in many Ecommerce sites as trading currency.

Chicago Board Options Exchange, the largest U.S. options exchange which has an annual trading volume of over $1.50 billion approximately, has also given recognition to Bitcoin by allowing trade with this cryptocurrency.

Even, Morgan Stanley, the American multinational investment bank, and Goldman Sachs Group, Inc., the pioneering securities, investment banking, and management organization in America, has also recognized Bitcoin. These two financial institutions have also given permission for trading with Bitcoin. Therefore, investing in Bitcoin can always be considered secured for investors of countries like USA, Germany and Japan.

Venezuela Case

While talking about Bitcoin, we have to think of the Venezuela currency crisis of 2019. When the Venezuela’s official currency rate was plummeting to all time low, having no other viable option in sight, the ordinary people of this country had to adopt Bitcoin as their medium of exchange. It helped several low-wage earners to safeguard their hard-earned money against the drastically devalued state-controlled currency. Now, so many countries are exploring the possibilities of issuing their state-backed digital currency shows the importance of Bitcoin.

The Final Take

It will be never wise to make a straightforward comment whether Bitcoin guarantees financial security to investors or not. As the study shows, a multitude of factors are at play behind it, which includes time of investment, market situation, country of investment, and so on. Hence, it would be better concluded that the approach of the investor, risk taking capacity, intuition and knowledge about trading in Bitcoin should be treated as determining factors for predicting if the investment would be secured.

By

Apara Bhattacharya

For INSTANEWSGRAM